Can I Sell My Car If It's on Finance

Find out if you can still sell your car with outstanding finance, in our latest guide.

Explore the greater flexibility offered by Personal Contract Hire with your new car.

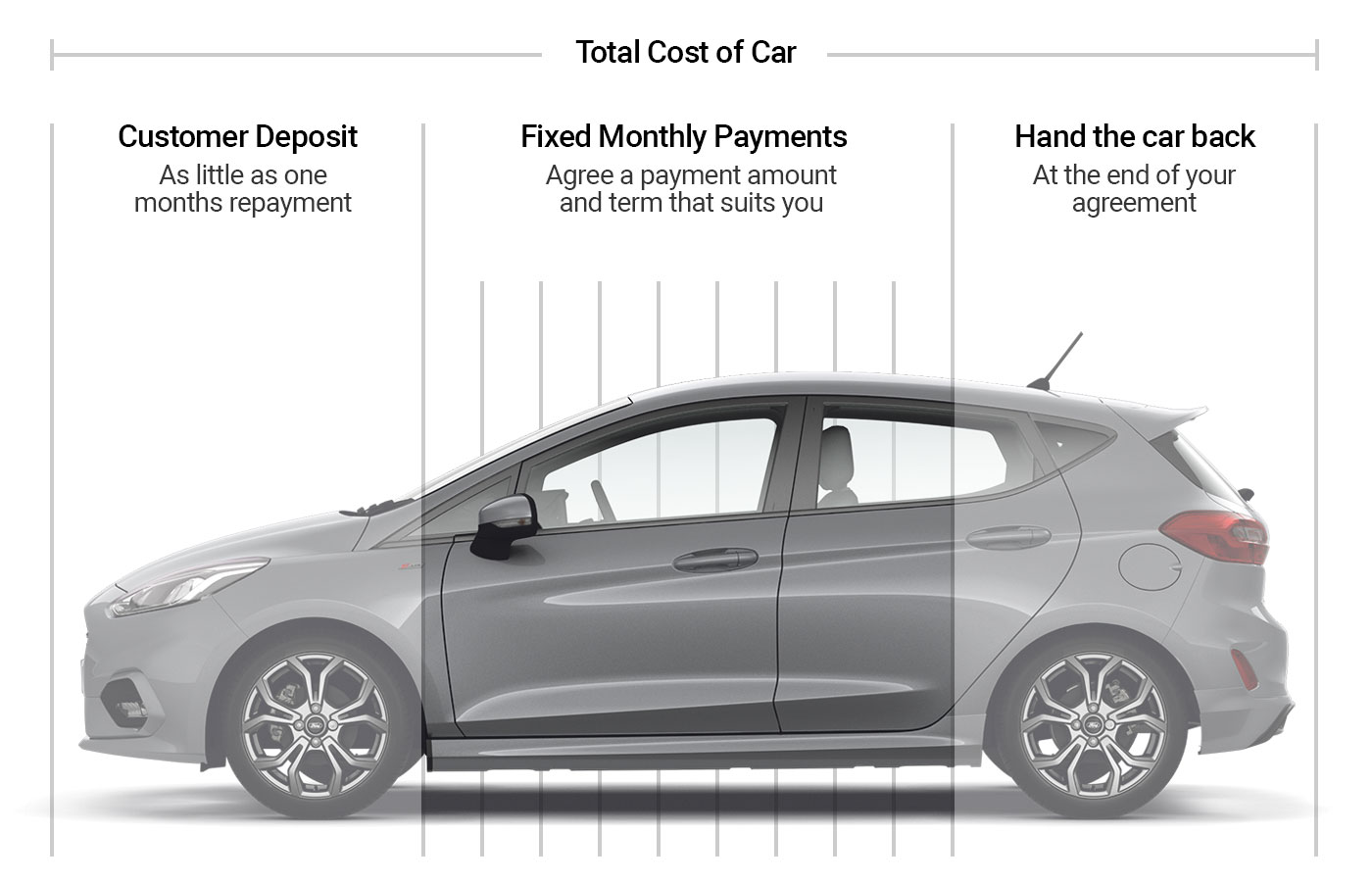

Personal Contract Hire is a flexible finance lease that covers the use of a vehicle, meaning the customer is never the owner. It is aimed at non-corporate, non-VAT registered customers and usually lasts between two and five years. A PCH agreement allows you to drive a new vehicle every few years without having to own it or worry about depreciation costs.

Explore our wide range of new cars. Whether you prefer to browse online or at your local dealership, our friendly team are on hand to offer their expert advice.

Once you have weighed up your finance options and decided that Personal Contract Hire is the finance plan for you, we can get started.

Use our finance calculator to build your Personal Contract Hire agreement. You choose the deposit and length of agreement that works for you.

Personal Contract Hire (PCH) is a flexible finance option that is great for fitting around your budget. With PCH finance, you can:

PCH finance is usually only available to people who have a satisfactory credit rating. To apply for a PCH agreement, you must:

Is PCH subject to a credit check?

As with any finance agreement, you will need to pass a compulsory credit check before you are approved for finance. If your credit score looks good, then your application should be processed.

Can you get PCH on used cars?

Unfortunately, no. Personal Contract Hire (PCH) is a finance agreement that is only available when hiring a new car.

What does PCH include?

With a Personal Contract Hire (PCH) agreement, road tax and breakdown cover are included in your monthly rental. You can also include maintenance costs for the vehicle within your monthly fees to help spread the cost further.

Note that PCH finance does not include insurance and you'll need to make sure the vehicle is fully covered. Legal ownership of the vehicle is also not included, as you are simply hiring the vehicle for a set amount of time.

What is a PCH agreement?

Personal Contract Hire (PCH) is also sometimes referred to as personal leasing. It's a form of finance agreement whereby you rent a vehicle for a certain length of time (for example, 24 or 48 months).

You pay an initial payment followed by monthly payments covering the use of the vehicle. You must also stay within the agreed mileage limit. At the end of the agreement, you return the vehicle and walk away with nothing to pay.

Can I get out of my PCH contract?

Yes, you can get out of a Personal Contract Hire (PCH) contract. However, it's often expensive and more complicated than with a non-leasing form of finance arrangement. You will likely be expected to pay off any remaining balance so it's best to consider carefully before entering into the agreement. If you're unsure which type of finance contract you need, we offer a range of other finance options to help you decide.

What happens at the end of PCH?

At the end of a PCH agreement, you will return the vehicle to the lender and walk away. If you have stayed within the agreed mileage limit and kept the car in good condition you don't have any additional costs to pay.

How long does PCH last?

A PCH contract can last between two to five years, with different options available to suit your needs.

Personal Contract Purchase (PCP) is a popular finance solution for new and used cars. It involves an initial deposit, fixed monthly payments, and flexible end-of-term options.

Learn more about PCPHire Purchase (HP) is another form of leasing agreement. You pay an initial deposit followed by fixed monthly instalments until the end of the term, where you will then own the vehicle at the end.

Learn more about HP

Find out if you can still sell your car with outstanding finance, in our latest guide.

In this guide, we will cover everything you need to know about HP and PCP finance so you'll have a better understanding when you come to buy your next car.

Find out what the laws are around cancelling car finance plans should you need to before the agreement end date.

We are a credit broker and not a lender. Finance is subject to status and finance company acceptance. We can introduce you to a limited number of lenders and their finance products. We will typically receive a commission from the lender, as either a fixed fee or a fixed percentage on the amount you borrow. The commission we earn does not change by the type of finance. A guarantee may be required. The finance rate will vary dependent of customer personal circumstances for in dealership purchases.