Can I Sell My Car If It's on Finance

Find out if you can still sell your car with outstanding finance, in our latest guide.

Finance your vehicle with our flexible Personal Contract Purchase (PCP) deals from Vertu.

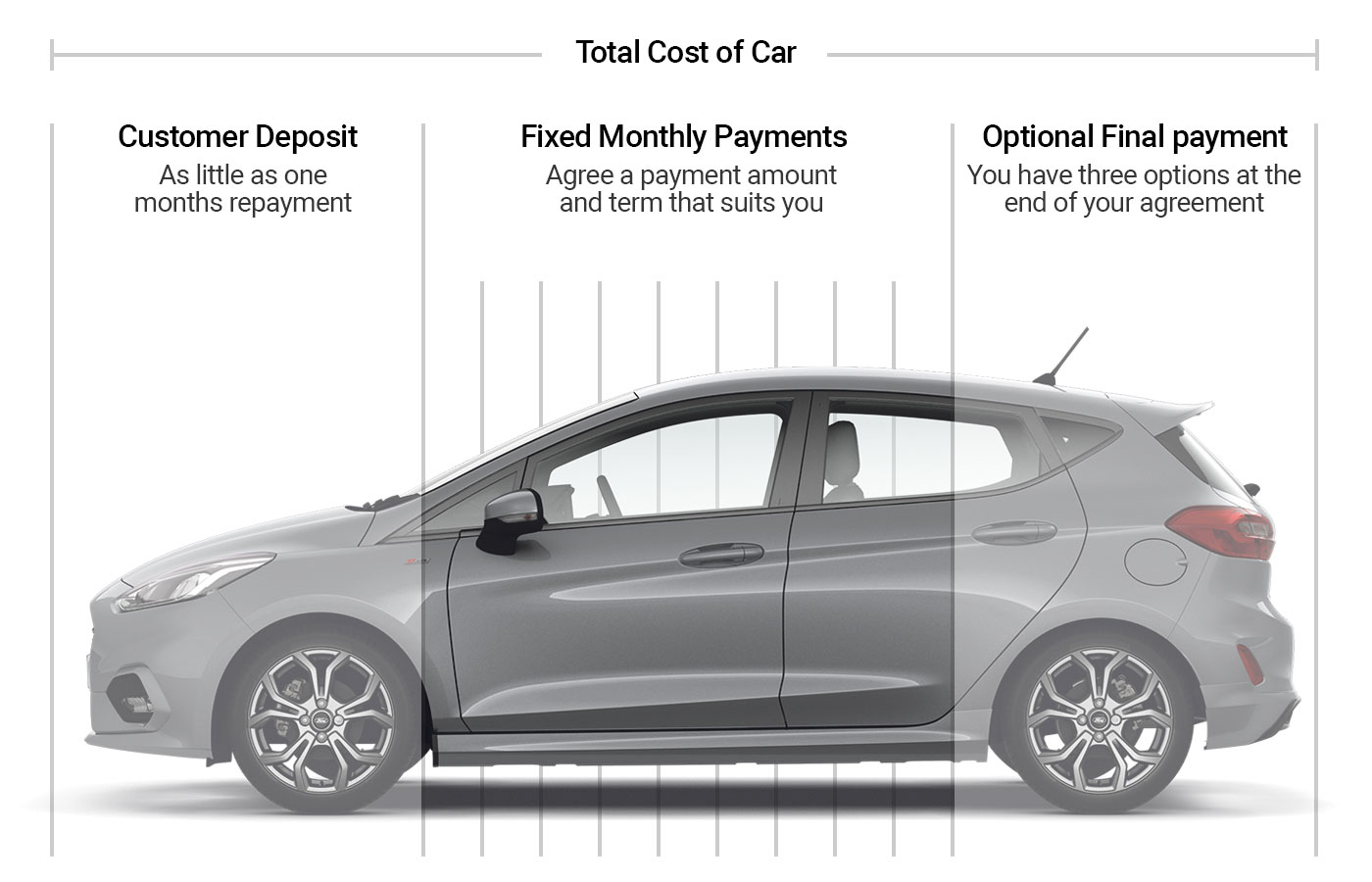

Personal contract purchase, or Personal Contract Plan, is a way to finance your vehicle. Sometimes considered as a long-term rental agreement, you pay monthly installments until the end of the contract. But, these do not cover the full cost, as the customer is only paying back a proportion of the total amount of credit as part of their monthly repayments.

Explore our wide range of new and used cars. Whether you prefer to browse online or at your local dealership, our friendly team are on hand to offer their expert advice.

Once you have weighed up your finance options and decided that Personal Contract Purchase is the finance plan for you, we can get started.

Use our finance calculator to build your Personal Contract Purchase agreement. You choose the deposit and length agreement that works for you.

Thanks to its flexibility, PCP remains one of the most common ways to finance a new vehicle. It's ideal for those who want a new car without the responsibility of ownership.

PCP is often only available for customers with a good credit rating. If your credit rating is less favorable, you can view our other available finance options. You can apply for PCP if you:

|

Representative Finance Example For Online Purchases |

|

|---|---|

| Customer deposit | £99 |

| Monthly payments | £272.01 |

| Cash Price | £15,000 |

| Amount of credit | £14,901 |

| Fees | £0.00 |

| Optional final payment | £6,912 |

| Total amount payable | £20,067.48 |

| Annual mileage | 8000* |

| Term | 48 months |

| Fixed rate of interest | 6.15% |

| Representative APR (fixed) | 11.70% |

| Customer deposit | £2,158 |

| Monthly payments | £227.90 |

| Cash Price | £10,956 |

| Amount of credit | £8,798 |

| Fees | £0.00 |

| Total amount payable | £13,097.20 |

| Term | 48 months |

| Fixed rate of interest | 6.09% |

| Representative APR (fixed) | 11.70% |

What is the difference between Personal Contract Purchase (PCP) and Hire Purchase (HP)?

Depending on your lifestyle, budget, and needs, both finance options have their benefits.

With PCP finance, you can choose whether to own the car at the end of the agreement. In comparison, with HP finance, you are the legal owner of the vehicle at the end of the contract.

The monthly payments with a PCP contract are lower compared to an HP contract. This is because if you wish to own the vehicle at the end of a PCP plan, you must make a balloon payment. With HP, you pay more throughout the agreement, but there is no large payment at the end.

What credit score do you need for PCP finance?

To be eligible for PCP finance, you must have either a good or excellent credit rating. For those with a lower credit rating, we recommend our other finance options. You can find more information on our Finance Explained page.

What is a PCP car finance agreement?

Personal Contract Purchase (PCP) is a common car finance option. It is a great way to get your dream vehicle by paying affordable, fixed monthly installments.

At the end of the finance contract, you can choose whether to own the car or return it to the dealership. If you want to own the vehicle, you must make a larger balloon payment. You can also get a completely new car with a new PCP agreement.

What happens at the end of PCP finance?

At the end of the PCP agreement, you can choose from three options:

Should I keep my car after PCP?

Depending on your needs and lifestyle, you can choose to buy the vehicle. If the vehicle has low mileage and it�s in great condition, keeping it may be a great option.

To get ownership of the vehicle, you must pay the resale value of the car, or a balloon payment. After making the payment, you are ready to continue your adventure with your car.

However, if you lack the finances to pay the balloon payment, or you rarely use the car, this may not be the best option for you.

Can I end my PCP finance early?

Ending your PCP contract early is considered a voluntary termination. You are allowed to do this if you have paid more than 50% of the total payable amount of the contract. All interest and fees must able be fully repaid before you can terminate the contract.

Ending your agreement early might be a suitable option for you if you cannot keep up with the monthly payments. If you decide to end your agreement early, you will not receive a refund, and you must return the vehicle to the dealership.

Can you finance a PCP balloon payment?

Yes, you can. To be eligible, you must have a good or excellent credit rating as well as an appropriate income. You can request finance for the balloon payment in several ways:

Can PCP finance be transferred to a new owner?

Unfortunately, no. During your agreement, the vehicle is owned by the company that provided your finance. The person who has borrowed the money must be the registered keeper and the main driver of the car.

Can you pay PCP finance off early?

You can complete the PCP contract early by paying the remaining balance. You can get this figure from your finance provider at any point during your agreement. This will reduce the amount of interest you pay throughout the contract.

If you pay your PCP finance and the balloon payment off early, the vehicle is legally yours. The finance provider is allowed to charge you an additional two months� interest with the amount of settlement.

At Vertu, you can find a range of other finance options available including hire purchase. You pay an initial deposit followed by monthly instalments until the end of your agreements. Once completed you will own the vehicle.

Learn more about HPPopular on new cars, personal contract hire lets you pay an initial rental payment, followed by fixed monthly payments. Once your contract comes to an end, you simple return the vehicle and start your search for your next car.

Learn more about PCH

Find out if you can still sell your car with outstanding finance, in our latest guide.

Car finance can be a difficult concept to get your head around. In this guide we walk through the process of selling your car if it does have outstanding finance.

If you're wanting to sell your car, but it has outstanding finance it can be tricky to work out the rules. Find out what is possible in our guide.

When it comes to financing your MINI, we like to keep things simple. Let us help you understand which finance product could best suit your needs.

We are a credit broker and not a lender. Finance is subject to status and finance company acceptance. We can introduce you to a limited number of lenders and their finance products. We will typically receive a commission from the lender, as either a fixed fee or a fixed percentage on the amount you borrow. The commission we earn does not change by the type of finance. A guarantee may be required. The finance rate will vary dependent of customer personal circumstances for in dealership purchases.